Is AI The Future Of Banking?

The pandemic is now the biggest and most critical challenge of traditional banking. Some of these challenges are revenue pressure, data security, customer service management, data collection and analysis, risk management, and so on. These are the warning lights and alarm bells that call for caution over emerging risks. AI (Artificial Intelligence) has gained recognition as an effective solution.

AI is empowering the banking industry to provide individualized frictionless customer experiences. It is driving customer loyalty and profitability by automating banking processes.

In this article, we will discuss how AI can resolve banking challenges. We will also discuss some of the common challenges banks might encounter in implementing AI and how a tech partner can help deploy AI better.

How AI Can Resolve Banking Challenges?

AI is the new electricity – Andrew Ng.

Modern technology such as AI can be tailored to the specific needs of the banking sector. The digital age is opening up new opportunities. According to a Business Insider research report, banks are expected to save an estimated $447 billion by 2023 with the help of AI applications. Given that, here is how AI can resolve some challenges.

Read more: Digital Transformation in Financial Services: All You Need to Know

1. AI-enabled conversational interfaces

Chatbots are one of the most popular cases of applying AI in banking. Bots are programmed to communicate with thousands of customers with minimum expense. Insider Intelligence estimates that the adoption of chatbots could save the banking sector $11 billion annually by 2023.

Mobile banking has become the most popular and chatbot services attract users’ attention and create a unique brand identity. AI functionality in mobile apps is helping banks generate more revenue than when customers visit their branches. Banking organizations that leverage AI improve their quality of services and remain competitive despite the crisis.

2. AI-enabled data collection and analysis

Banks generate an enormous amount of data every day. Collecting and recording this data is an overwhelming task for employees. Besides, all this work may be a wasted effort if there is no proper plan to use this data. Hence banks need to determine the relationship between the collected data. That is another major challenge.

AI-based apps improve the user experience by collecting and analyzing data. The collected data then can be used to grant loans or fraud detection.

3. AI-enabled Risk management

Providing loans is a challenging task for bankers. Extension of credit to a fraudster can get the bank into difficulties. Or a borrowers’ economic downturn can adversely affect the bank. 2020 statistics show that credit card delinquencies in the US alone rose by 1.4% in a duration of six months.

AI-enabled systems can appraise a customer’s credit history more accurately. Additionally, AI-powered mobile banking apps track financial transactions and analyze user data to help banks anticipate the risks associated with the extension of credit.

4. AI-powered data security

Credit card fraud is on the rise. It is the most common type of personal data theft. AI-powered systems can analyze customer behavior, location, and financial habits. So, if it detects any unusual activity, it triggers a security mechanism immediately.

Read more: Artificial Intelligence and Machine Learning: The Cyber Security Heroes Of FinTech

When all these challenges are successfully tackled, how does the AI-powered bank look like? Read on to find out.

How Does The AI-First Bank Look Like?

AI-bank rises to meet customers’ expectations and remain competitive. The AI-powered bank will offer intelligent and personalized propositions and experiences as it understands customers’ past behavior. It can span across multiple devices providing a consistent experience to its customers.

What Are The Common Challenges Banks Might Face In Implementing AI?

Implementing AI technology in banking is not always easy. You need to ensure you have the right team and expertise. You will also need access to data, resources to invest in the project, and parties that are willing to adopt the new technology.

- Access to data: It is one of the biggest challenges to implementing AI. Additionally, banks might face challenges with training data. It becomes hard to update or improve the AI models if the team does not have the necessary information to use and learn from.

- Localization: Localization is critical to the banking sector as they often need to design models with multiple markets that they serve. Localization can help you properly customize the customer experience. Your data partner can support you with localization as they have skilled linguists to develop aspects such as style guides and voice persona.

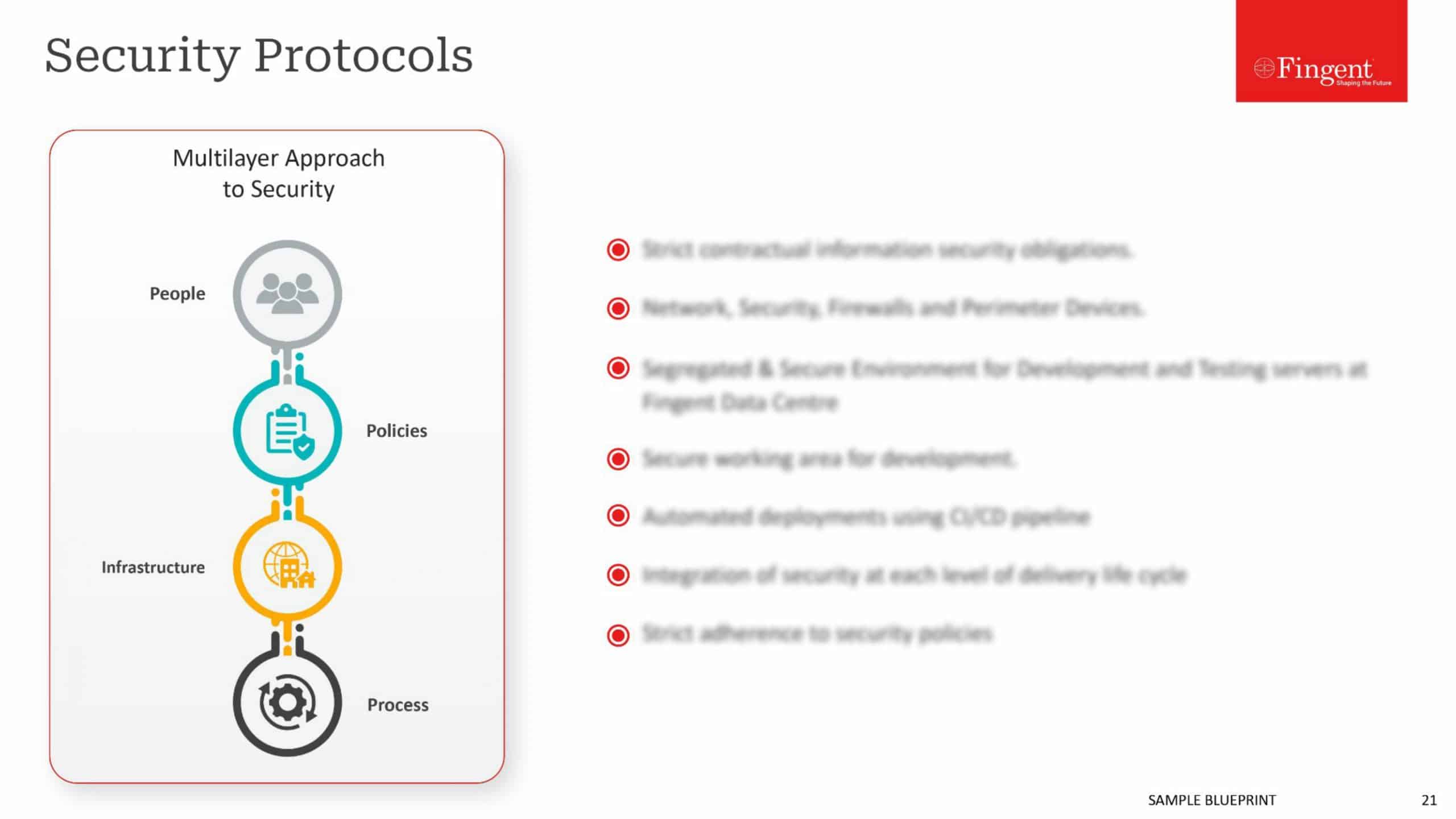

- Security and compliance: It is quite challenging to keep all the data confidential and secure. The right data partner can offer a variety of security options. They have security standards to ensure your customers’ data is securely handled. Look for data partners who have strong data protection with certifications and regulations. They will be able to provide secure annotation. They will also provide onsite service options, private cloud deployment, on-premise deployment, and so on.

- Trust, transparency, and explainability: AI models can only be successful if they can be understood and trusted by customers as they will want to be sure that their personal information is handled and stored securely. Talk to your partner and ask them to explain the model to you. Or you can always go back to the training data that was used to develop the model and extract some explainability.

- Data pipelines: Connecting data pipeline components to use siloed data is not as easy as it seems. To do this effectively, banking institutions must ensure their data is collected and structured correctly. They must also ensure that this information enables ML models to predict according to the business goals. Look for a partner with extensive security offering as their expertise will enable your banking service company to be successful and scale.

Read more: The New Untapped Opportunities for FinTech Companies in the Coming Years

How A Tech Partner Like Fingent Help Deploy AI Better?

Implementing AI into banking is a serious responsibility. It takes in-depth knowledge, an enormous amount of time, and dedication to accuracy. That is what Fingent has. We do not just follow the trends. Instead, we focus on how AI can add value to your particular banking needs.

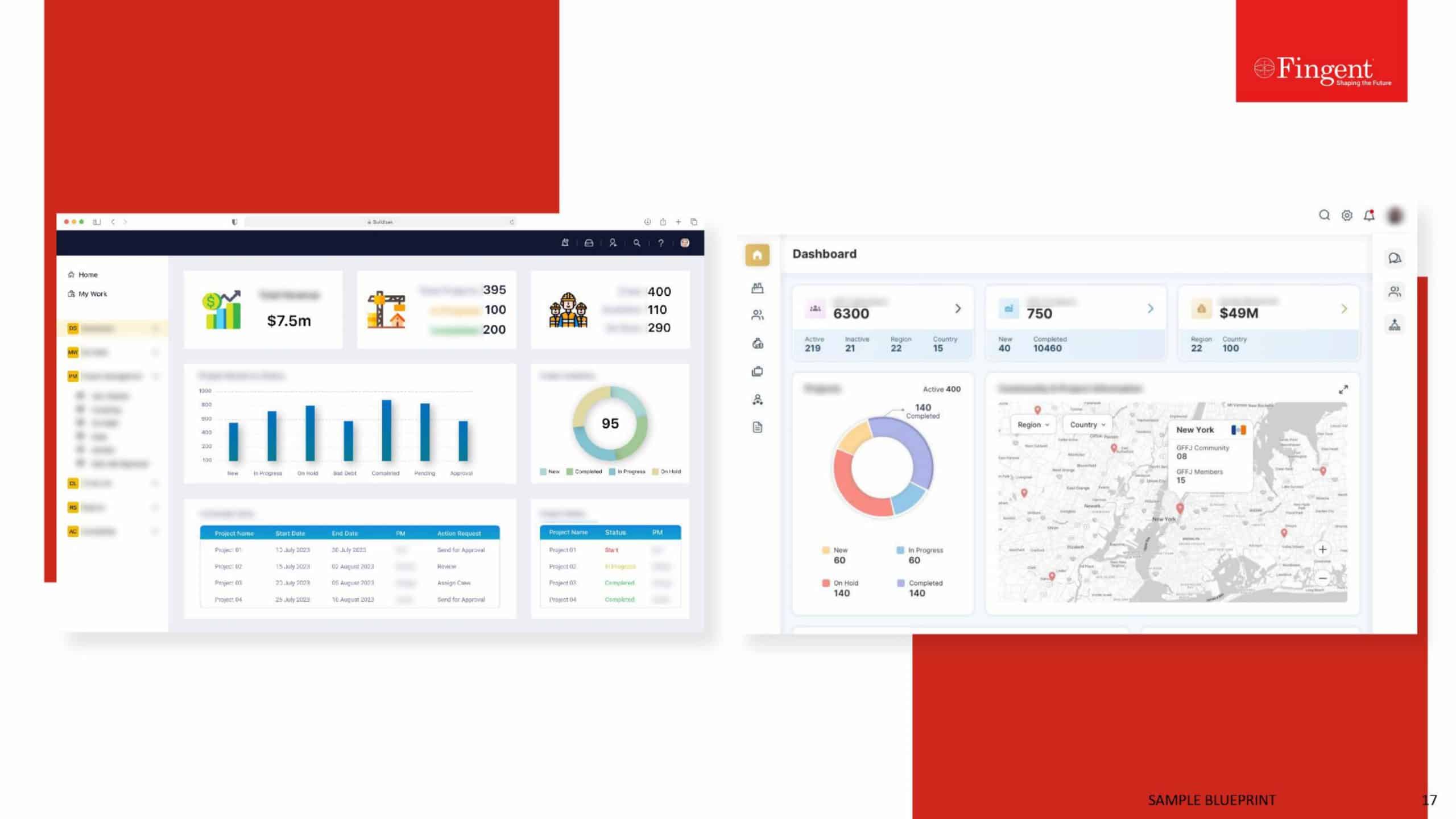

Fingent top custom software development company, can bring transparency and explainability of AI automated decision making to your banking processes. We can provide an easy-to-use interface through APIs delivered either on-premise, in the cloud, or as a SaaS offering.

By embedding AI and ML into our products, we can accelerate the release of explainable business models that will underpin new AI use cases. These can help create a seamless customer journey and automate manual processes with self-learning capabilities. We are confident that we can help you deploy AI better. Give us a call and let’s get talking.

Stay up to date on what's new

Recommended Posts

08 May 2024 Financial Services B2B

AI Shaping the Future of Financial Services: Use Cases & Applications

As Dan Schulman, the CEO of PayPal once said, “We're not trying to reinvent the wheel; we're trying to perfect it.” Achieving perfection is no easy process. It is not……

24 Apr 2024 B2B

A Leader’s Blueprint for AI Success

"Leaders, embrace AI! Make it your superpower!" - Robert Barber, Leadership Development Trainer and Executive Coach. How Are Businesses Using AI? The verdict is crystal clear—leaders today must embrace AI to……

18 Apr 2024 B2B

Applied AI For Document Processing

"It's becoming increasingly clear that AI is the future, and almost everything else is a sideshow." - World-renowned computer scientist Geoff Hinton AI has taken over almost every aspect of……

21 Feb 2024 B2B

Stepping The AI Revolution with Applied AI

“I am telling you, the world’s first ‘trillionaires’ are going to come from somebody who masters AI and all its derivatives and applies it in ways we never thought of.”……

Featured Blogs

Stay up to date on

what's new

US

US Insurance

Insurance